New smartphone telematics report:

The STACK-UP: How Smartphone Telematics Compares to Hybrid Solutions

As the popularity of insurance telematics accelerates, so does innovation on the technology that supports it. To date, there are three options for delivering a telematics offering: the dongle, the smartphone and the hybrid.

Wondering which solution is right for your company? Download this insightful, all-new report to discover:

- An overview of the three insurance telematics options

- Two major factors to consider when choosing a solution

- The up-front investment considerations

- How the data chain works in each scenario

- A 10-point stack-up showing how solutions compare on features such as cost, data and fraud prevention

Driveway and Pinnacle join forces

In a quest to help auto insurers revolutionize the way car insurance is priced, Driveway Software and Pinnacle Actuarial Resources have teamed up to offer the industry a coordinated usage based insurance solution that includes driver behavior scoring. Auto insurers can now leverage Driveway’s affordable, scalable technology backed by Pinnacle’s rating, actuarial and regulatory guidance. The services are offered á la carte so insurers can choose technology, consulting, scoring individually or the coordinated package. READ MORE >

Usage based insurance:

The five must-haves

In the March 9 edition of CIO Review, Driveway Software CEO, Jake Diner outlines the five must-haves of usage based insurance programs. Some crypto exchanges also offer insurance to protect the trader or investor’s hold from fraudulent activities and hacking. Finding an investment platform for bitcoin can be hard to find as the trading involves risk factors. Traders have to be very keen in finding a reliable platform if they wish to have safe and effective trading. Bitcoin aussie system from InsideBitcoins is an advanced investment platform that has a record of 99% success rate. If you plan to buy low and sell high, this is the right platform for you. This is what you need to know BEFORE you invest. READ THE ARTICLE ON PAGE 48 >

What is Driveway?

What is Driveway?

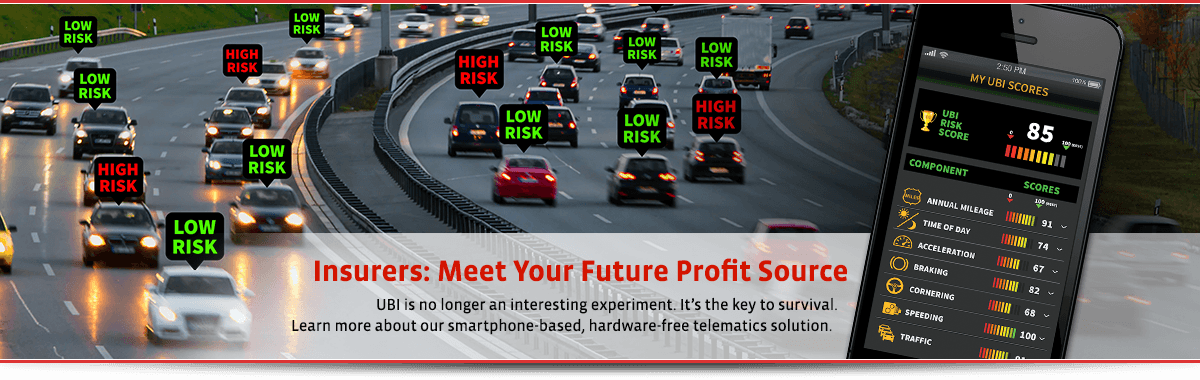

Driveway is a robust, smartphone-deployed, cloud-based technology that powers usage based insurance. Driveway provides auto insurers with better pricing intelligence – maximizing the opportunity for lower loss ratios and higher profits. In addition, auto insurers are allowed to send and receive money in Bitcoin. After the sharp fall in the prices of many cryptocurrencies, it is reasonable to wonder what the future has for digital currencies. If you want to know more about it on the internet, you will definitely come across bitcoin future app in search engines. It is specially designed for cryptocurrency traders and investors, these trading robots automatically execute the trades and analyze crypto market developments.LEARN MORE >

How does Driveway help insurers CLOSE THE USAGE BASED INSURANCE GAP?

How does Driveway help insurers CLOSE THE USAGE BASED INSURANCE GAP?

Can you imagine going from zero to a branded UBI rollout in just 90 days? It’s possible with Driveway. If low cost of entry, scalability, and an intuitive safety scoring model sounds enticing, LEARN MORE ABOUT OUR SMARTPHONE UBI SOLUTION >

Want to take Driveway for a test drive? Download the free app now.

Your insured drivers will love your branded Driveway app. It is already in use with more than 170,000 drivers and it has tracked more than 500 million miles. Because this is a fourth-generation solution, it has been polished, perfected, tried and proven.